Analytics and Resources

IMB Center analyzes the forecast demands of major Operators and the potentials of the local market.

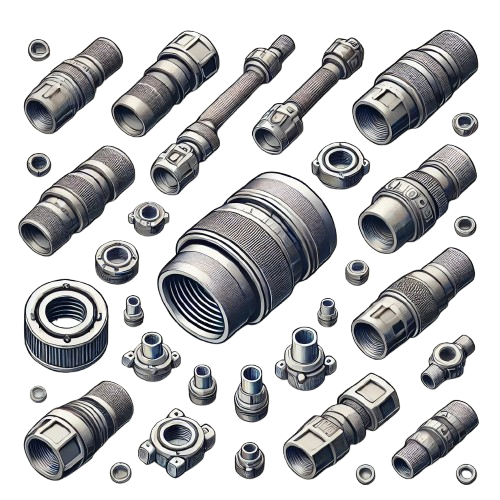

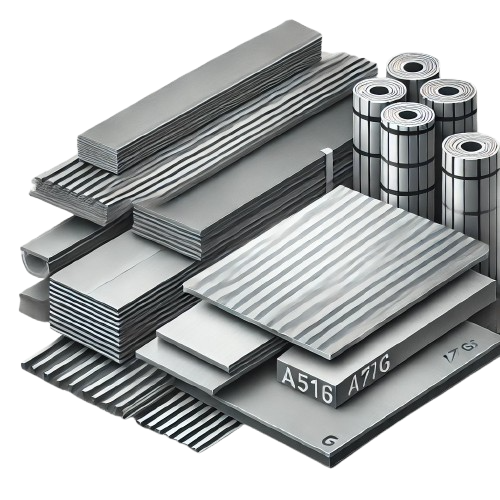

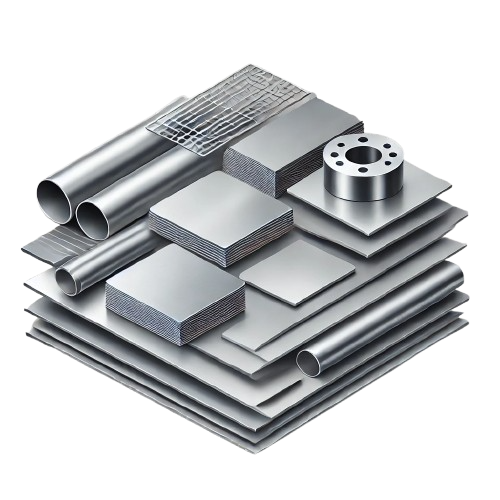

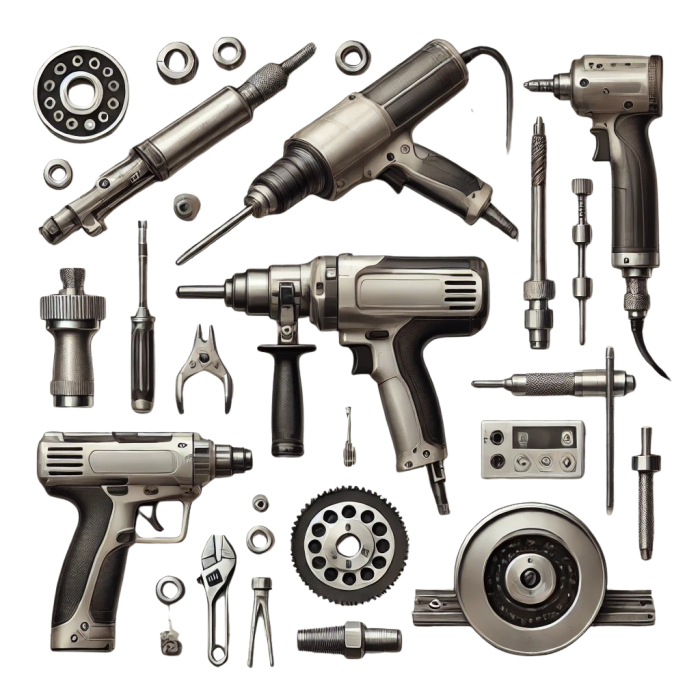

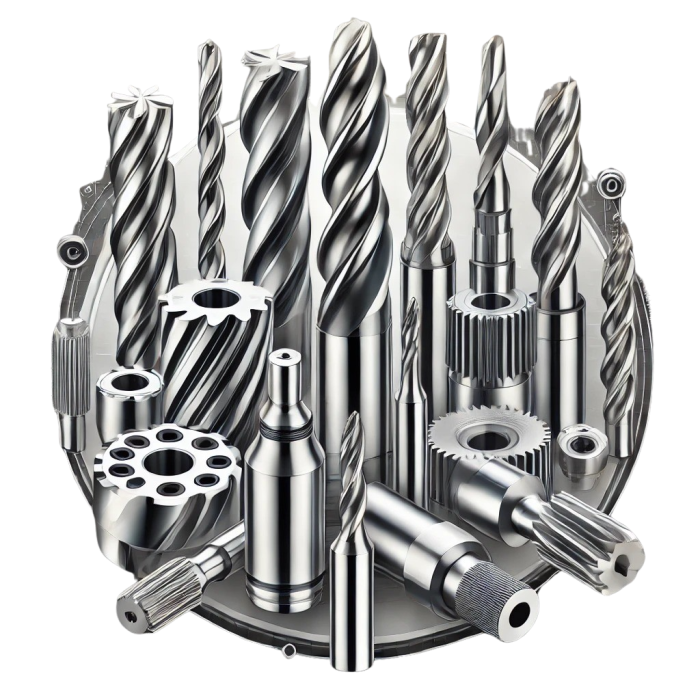

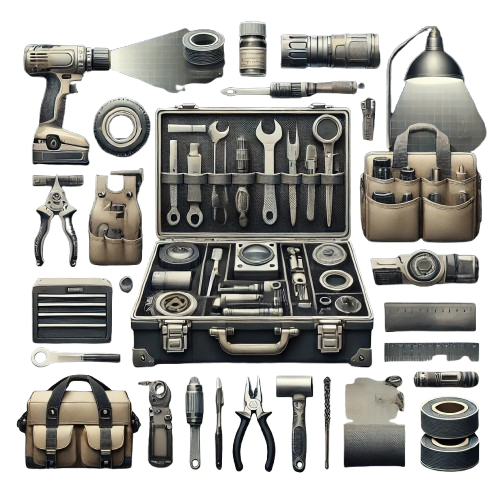

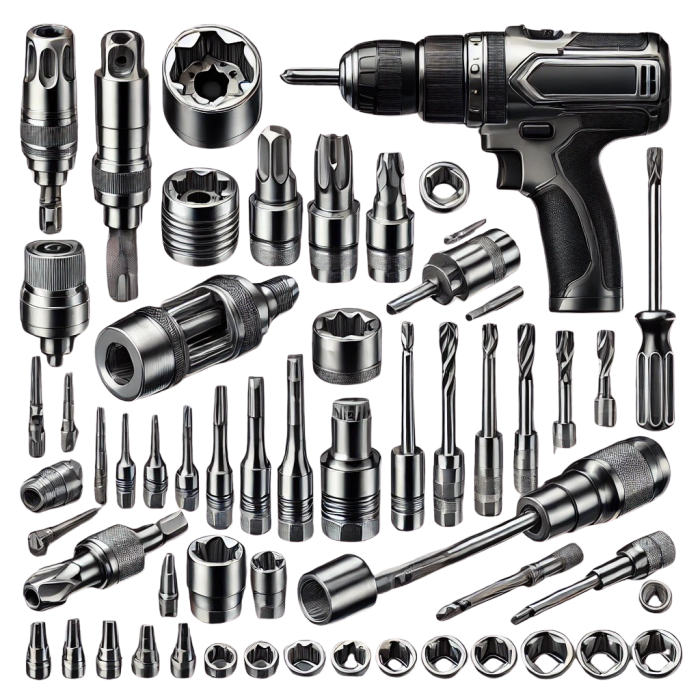

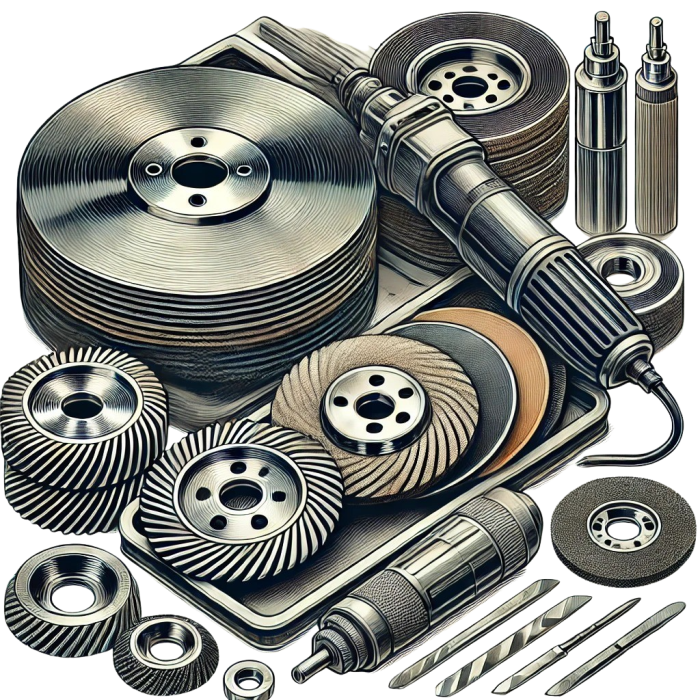

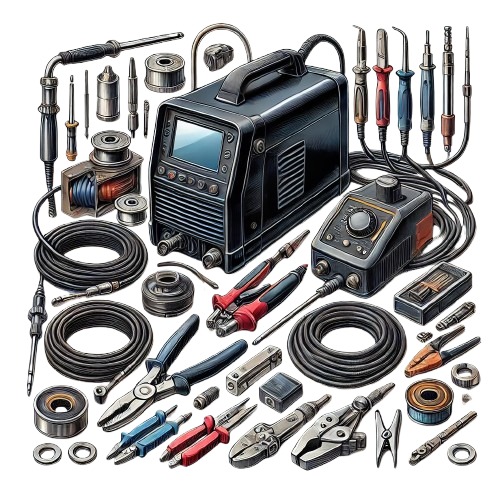

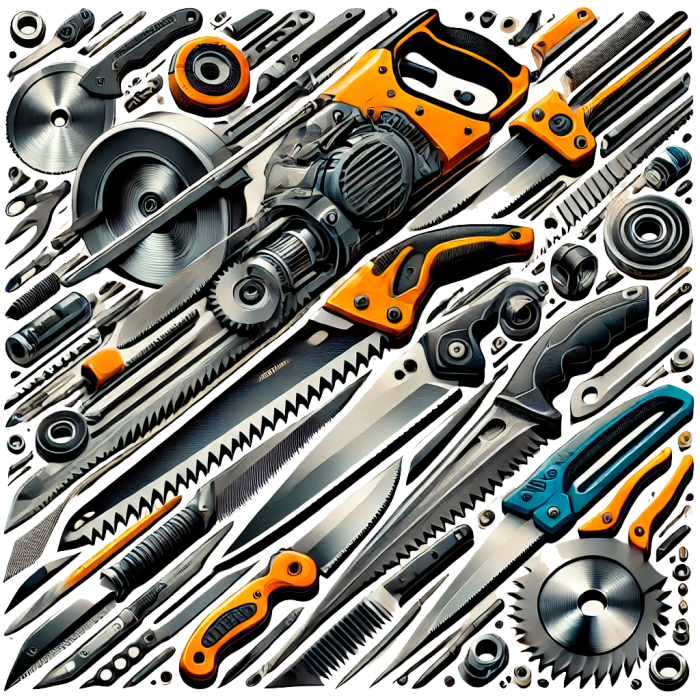

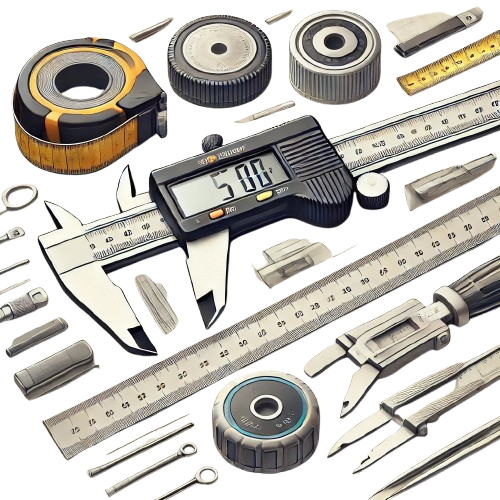

In-demand goods

- The quantities of the demands represent the consolidated demands of all 3 Operators (TCO, NCOC, KPO) and are based on the 10-year forecasted figures provided by Operators. The figures are of indicative nature only and are subject to change based on the market conditions as well as the operational plans of the Operators.

- Provided data shall not be considered as a commitment by Operators, collectively and individually, to conduct any activity or an offer by Operators, collectively and individually, to any person. Operators, collectively and individually, explicitly waive any responsibility or liability for any damages or losses that may be sustained by any person arising out of or in connection with such person’s reliance on the provided data.

- These quantities are based on the Operator’s historical figures and may not necessarily include the demands under major expansion projects such as the Karachaganak Expansion Project Phase 1, Kashagan Phase 2 etc., wherein the procurement of such goods and the related works may be performed by the EPC/pC contractors responsible for the projects, which should also be considered in your business plans. Demands include various units of measures such as kits and assemblies, which may ultimately entail quantities (in pcs/ea) larger than what is depicted.

* Sub-groups of goods with the largest shares in terms of quantities under the respective groups of commodities are presented.

General economy outlook

Despite the high growth potential, currently the RoK machine building sector is playing a rather insignificant role in the country's economy with respective share of 3.0% of GDP in 2022 and 4.0% of GDP in 6 months of 2023, and an average of 2.3% over the last decade. After the end of the investment cycle driven by the State Support Program SPAIID (State Program of Accelerated Industrial and Innovative Development of the Republic of Kazakhstan, the share of the machine building sector in GDP in 2015 decreased sharply from 2.3% to 1.6%. Since then, the sector has shown a stable positive trend.